One of the most recent areas to look at cryptocurrencies ‘s the homes finance field. Multiple best users regarding the space are in reality giving a beneficial crypto mortgage loan’ that enables users to get home using the electronic assets. Intrigued?

Crypto mortgages discover the latest doors for those who possess the internet worth during the electronic possessions. About volatility out-of crypto, it now have a method towards still waters regarding actual house rather than offering their electronic property or losing their HODLer updates.

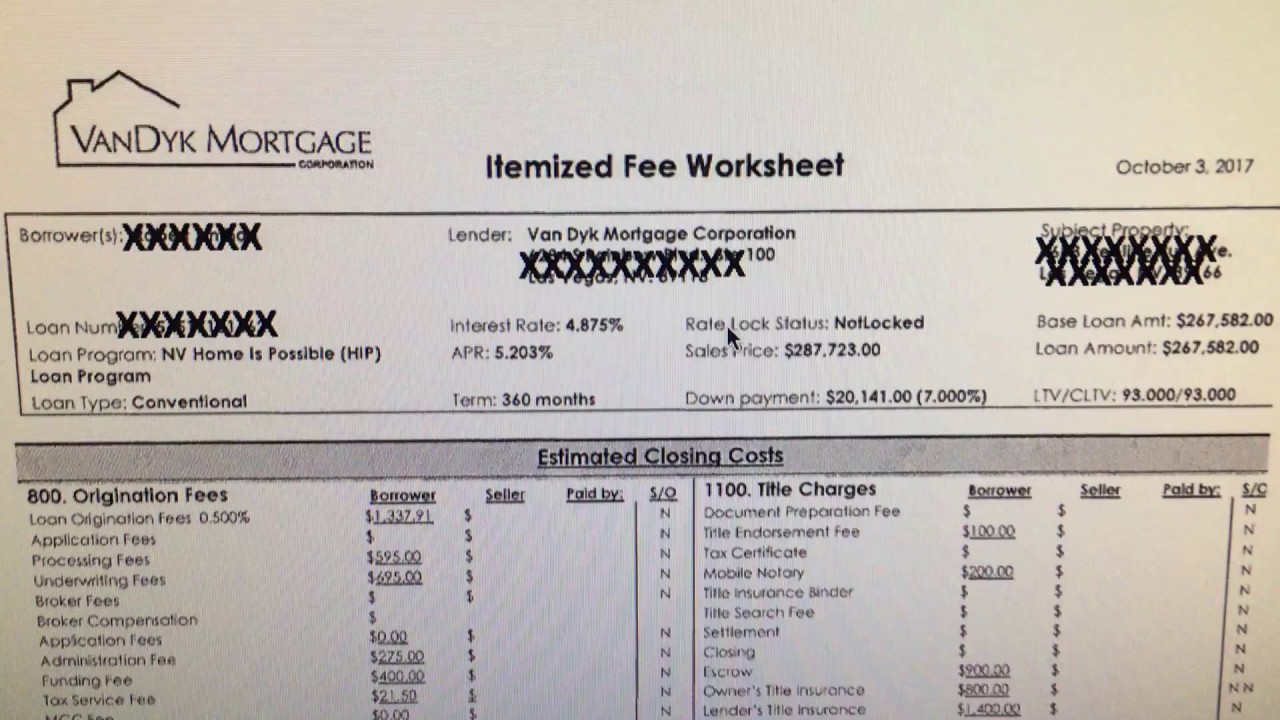

When it comes to a vintage mortgage, a candidate would have to confirm his income with salary slides and you may bank statements, with an intensive credit check. With crypto mortgages, these conformity is reduced.

You can get as much as 100 percent of the number must find the domestic of the collateralizing crypto worth an equivalent number. The eye rates range between agencies in order to agency, but these are generally much cheaper than just non-collateralized loans.

All a person has to complete are inform you/prove the new holdings out of particular greet cryptos (usually simply for some traditional tokens), and you are entitled to a mortgage which is backed by crypto due to the fact collateral

The stage should be between per year and you will three decades – a standard for real house financing. And you can loan providers about U.S offer financing quantity ranging from USD 5 mil so you’re able to USD 20 billion. You will also have the option of paying monthly instalments because of accepted cryptocurrencies along with fiat currency.

The fresh crypto financial marketplace is rising currently from inside the Northern America, having participants such as for instance Shape and you can Milo bringing hub stage and delivering electronic assets-backed money to people

The first and more than great benefit of crypto mortgage loans is the fact you don’t have to sell your own crypto holdings. Individuals bullish on the crypto faith the current prices are just a minority out of what they shall be. Thus, carrying electronic property and you may divesting them into a house is significantly much better than outright offering all of them.

The following great virtue ‘s the get down taxation. In most places, along with India, fees towards the crypto are backbreaking. Although not, youre relieved of one’s tax weight having a good crypto mortgage mortgage given that you are not attempting to sell your electronic possessions, merely collateralizing all of them.

The 3rd virtue ‘s the omission away from data files instance fico scores, paycheck glides and financial statements one or even impede construction fund. Lenders regarding the U.S don’t necessarily inquire about fico scores and you will bank comments, even in the event with these types of data ready is an advantage.

Finally, when your worth of brand new guarantee develops significantly once you have pledged they, you can take advantage of a greater mortgage or a moment financing for the increment inside worthy of.

The most common https://clickcashadvance.com/personal-loans-oh/ drawback arises from this new volatility out of cryptos property. If there is a sudden shed into the rates, you might have to promise far more security, or it could lead to the liquidation of house. While it’s not likely that mainstream cryptos often slide to help you no, you’ll have to build choice collateral preparations when they would.

Another downside is you cannot use the pledged digital possessions having exchange or any other passion. This new assets are held because of the financial seller, and is only stored and absolutely nothing more. Consequently, you could potentially overlook making money courtesy trade, staking or give farming the brand new cryptos you’ve got bound.

The last downside is that the variety of cryptos you could potentially guarantee is extremely simply for brand new conventional cryptos particularly BTC, ETH, USDC and USDT. If you’re an owner of any almost every other crypto, crypto mortgage loans might not be to you.

As soon as possible, Asia might have its professionals too. More to the point, we would understand the crypto home loan community swinging past a house, making forays to the a number of other companies and you may areas.