And getting capital, you’ll also need certainly to make sure to have a great cluster by your side -particularly when this is your first-time investing property. Financial support very first investment property would be hard -and perplexing, and it’s important to understand that you don’t need to do it by yourself. Which have a qualified real estate professional , insurance broker, and you can attorneys with you will help the method to go alot more effortlessly. If you’re planning so you’re able to book the home, additionally, you will be interested in hiring the expertise of a home manager -particularly if you lack time to manage the house on your own, or if perhaps you are thinking about investing a property that’s out out of city . Also, it is best if you always keeps a keen educated accountant just who knows money spent strategies. Selecting legal counsel that is experienced in house protection will additionally allow you to means suitable build to own carrying your investment possessions -have a tendency to, this will be a restricted liability business -something that will help save from potential losings is to anything get wrong. Centered on Steeped Father Advisor, Garrett Sutton , carrying investment property in your name exposes the a residential property and private property when the case comes up.

Ultimately, you’ve complete your search -do you know what your options was and you will where you are. Now you have to do this. You ought not risk get into instance a dash which you decide to buy a costly assets, or buy something that is not going to provide the financial production that you’re after. Nevertheless when you have over your homework, and you can what you checks out, will ultimately you will must take the leap.

“The biggest deadly package disaster of all try concealing at the rear of study as you are afraid to get the fresh result in for the offer,” says Peter Conti , author of The actual Estate Quick Track: How to get good $5,000 to help you $50,000 30 days Real estate Income. “From the a particular area since the a trader, try to step forward on price and you can commit.”

Consider taking associated with an owning a home club, or wanting a economic mentor who are capable answer your questions and you can guide you from the process. This will make it simpler to see whether a prospective possessions is a great deal; that give you depend on that you should improve final call.

You will need to end up being patient regarding their credit score

In the long run, as with any financing, you should always purchase possessions as you are able to afford. The very last thing that you would must do will be to overextend your finances to the level of being incapable of keep up together with your costs. Thus, it’s best to go to an authorized societal accountant before making people behavior, to decide a course of action that is best for debt disease, in order to find out how investing in property will impression you from a tax viewpoint .

If you take into account every details -and you can carefully evaluating the money you owe, plus examining most of the offered money solutions prior to securing that loan will help you to collect every piece of information that you should make a knowledgeable decision -enabling you to with certainty favor a money method that will help you you to get the best efficiency you can easily.

Do you want doing the investment venture? And this financial support possibilities sound the essential encouraging for you?

To keep up good credit, frequently display your credit score, constantly help make your repayments on time, and then try to handle any problems or discrepancies when possible. You will do not want more than-making use of your borrowing from the bank to help keep your score higher -attempt to care for credit card stability that will be lower than 30 percent of the borrowing limit.

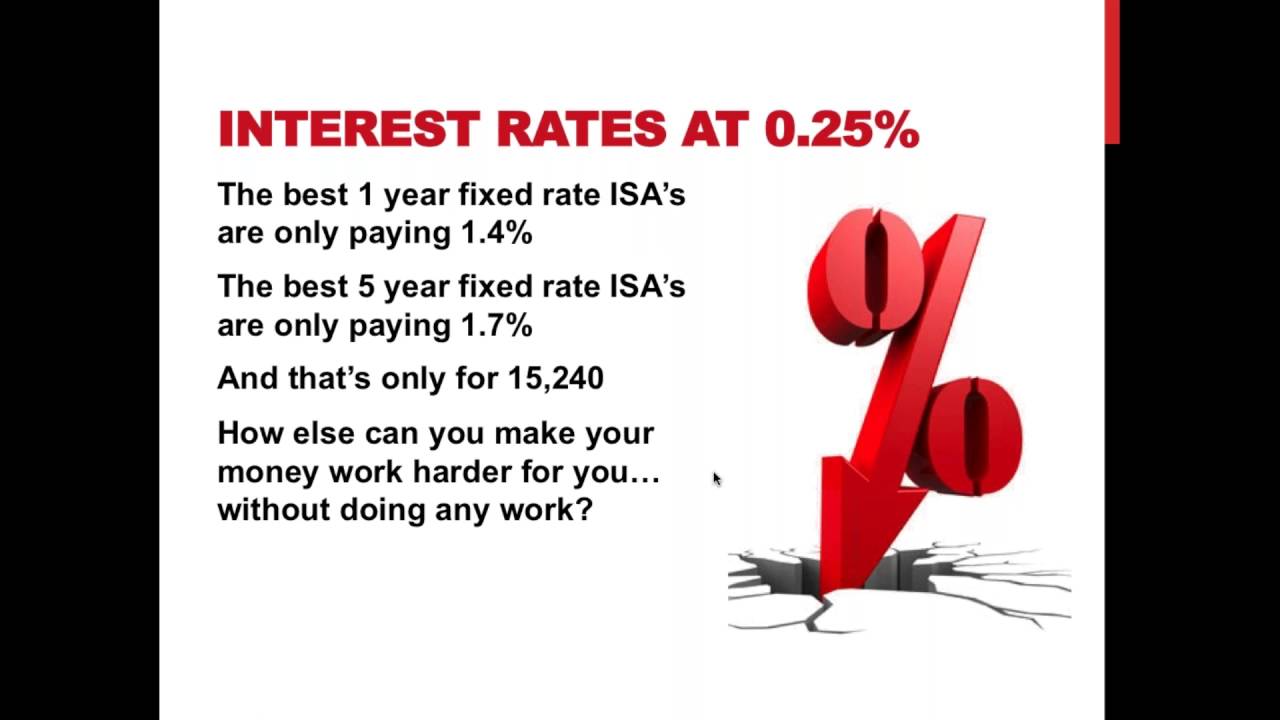

An alternative choice getting residents was refinancing and utilizing the money to help you get a residential property. Definitely, brand new feasibility of solution all hangs largely about precisely how lower-interest levels try, and exactly how much security you may have in the home -however with ascending home values, you can have over you believe. Once you have ordered an investment property, you may then refinance one assets once annually as well.

One benefit from his comment is here a lease-to-very own home is this offers a while to help you secure resource -or, to change your credit rating prior to trying to purchase. Sometimes, you might also be able to pertain all the or part of the newest lease costs on the bill of the property. Before entering into a rent-to-own contract, you will need to have a lawyer draft right up a contract, making sure that you and owner take the fresh new exact same webpage.

None are getting a vintage financial loan

Another way to loans the investment is by teaming with a security, or money spouse . When you are a private bank will get focus with the use of their funds, a collateral mate tend to express regarding continues of the local rental possessions.

Off-industry properties , or wallet postings, was home which can be for sale, however, aren’t listed on the several number properties (MLS) -such functions are ordered owing to phrase-of-mouth area or lead revenue. A from-business possessions doesn’t constantly ensure a better offer, however, sometimes you can find residents with an increase of flexible words -they ple. In some instances, you can find functions as possible get no off commission. Construction directory continues to be limited in several places over the states -and off-sector postings can assist you to pick probably top sales. Here is how you could start searching for out-of-markets attributes .

Additionally need to survey neighborhood local rental market to get a sense of what you could predict when it comes to local rental money out of your property. Start with thinking about websites like Zillow and you can Trulia . Enjoying any alternative, comparable qualities opting for direct you what you could predict with your own personal possessions.