The newest Federal Set-aside aggressively tightened up economic rules for the 2022, addressing large and you will chronic rising cost of living. The fresh resulting borrowing rates increase getting property and you may agencies are generally anticipated. Yet not, fixed-rate financial rates of interest was in fact specifically sensitive to the policy regime transform.

We find you to definitely interest volatility plus the unique characteristics of mortgage instruments was basically crucial members to help you last year’s outsized mortgage speed motions.

Provided rapidly tightened up financial coverage

The brand new Government Put aside began the modern financial rules cycle from the their appointment by improving the government loans rate address of the 0.twenty five fee facts, to 0.250.50 %. Due to the fact rising prices remained persistently increased, the new central financial continued lifting the goal at the next group meetings. The speed endured from the cuatro.254.fifty percent within 12 months-prevent.

Brand new Federal Set-aside opinions transform with the government loans rate’s address assortment as the no. 1 technique of changing monetary rules. Yet not, the new main financial along with started decreasing the measurements of its balance sheet-which includes Treasuries and you may financial-recognized bonds-inside the by the restricting reinvestment away from principal payments to the the maturing holdings.

The brand new impulse of a lot of time-term rates of interest to that toning period might have been reduced pronounced than the upsurge in the insurance policy rates. The brand new 10-year Treasury speed started 2022 around step 1.six %, peaked around 4.2 % inside late Oct, and you will stood at almost 3.8 per cent from the season-stop. Very, just like the federal money speed address ran upwards 375 foundation items (step 3.75 commission things), brand new standard a lot of time-label Treasury price moved right up merely 220 base affairs.

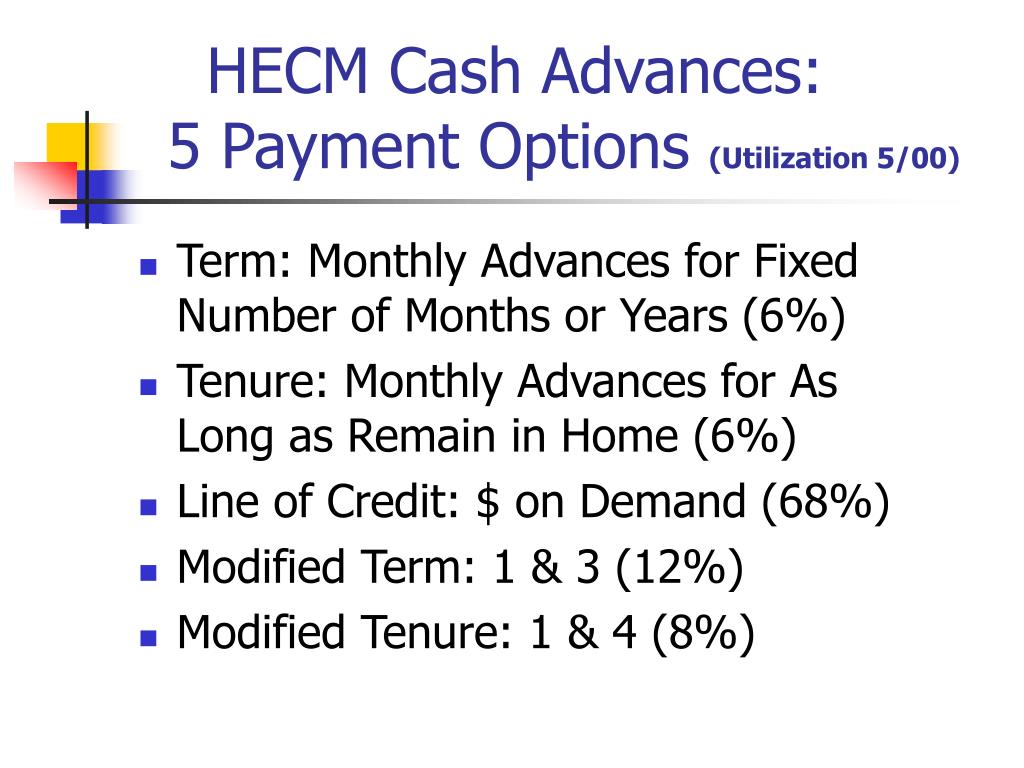

You to definitely may think one home loan costs manage directly song enough time-label Treasury pricing. You to wasn’t the scenario (Graph step one).

The common 30-year repaired-rate financial began 2022 from the step three.1 percent, peaked within the late October on eight.one percent and you may ended the season in the 6.cuatro %. When you are one another 10-seasons Treasuries and you may mortgages enhanced along side year, its differences was sixty basis circumstances in the very beginning of the 12 months, extended to as much as 190 foundation issues during the October, and you can stood within 150 foundation factors during the seasons-stop. What makes up about the important expanding among them?

Decomposing mortgage rates

Home loan interest rates one to houses pay to shop for otherwise refinance belongings are called top cost. A frequently cited way of measuring such rates arises from Freddie Mac’s First Financial Field Survey, the information and knowledge source for Graph step 1. This a week declaration has got the mediocre rates of interest for https://paydayloanalabama.com/scottsboro/ earliest-lien old-fashioned, compliant fixed-speed mortgages that have a loan-to-worth of 80 percent. Old-fashioned conforming mortgages are the ones entitled to securitization-or resale to traders-as a result of Freddie Mac computer and you can Federal national mortgage association. Both of these authorities-paid enterprises (GSEs) accounted for almost 60 percent of brand new mortgage loans through the 2022.

The basis getting primary rates ‘s the additional-business interest rates paid back to traders holding consistent mortgage-supported ties (UMBS) guaranteed because of the Federal national mortgage association or Freddie Mac. UMBS manufactured and you will traded with savings (interest repayments in order to buyers) from inside the 50-basis-section increments. The brand new additional rates consistent with an effective UMBS on face value (generally, face value) is called brand new most recent voucher rate.

Chart 2 displays the main-mortgage-industry rate (just what homeowners spend) and secondary-. The essential difference between the 2 show-and/or primarysupplementary give- reflects several situations.

Earliest, the traditional compliant financial consumers spend twenty five foundation affairs to possess loan maintenance. 2nd, Fannie mae and Freddie Mac computer costs guarantee charges to be sure prompt fee out-of principal and attention with the UMBS. Eventually, mortgage originators have to safety the will set you back, plus a profit for the guarantee, that could are very different over time because of financial consult. The mainadditional spread, which averaged around 105 base products while in the 2022, failed to showcase a trend which will account for this new broadening in accordance with enough time-title Treasury cost for the period.

Chart dos illustrates your higher escalation in pri is actually motivated because of the secondary-field prices. Conceptually, one can possibly contemplate secondary-industry pricing because the showing the sum of an extended-name exposure-totally free speed (to have convenience, i let you know the newest 10-year Treasury rates) together with cost of a trip alternative that enables borrowers so you’re able to prepay its mortgage loans when rather than punishment.

Which carried on prepayment choice is expensive to loan providers since it is resolved with greater regularity if this professionals new debtor on expense of one’s bank, as the individuals refinance to your lower-price money. The essential difference between the fresh new additional-market speed and stretched-old Treasury pricing can be regarded as the cost of the latest prepayment choice.

Interest volatility widens mortgage develops

Solution thinking raise into volatility of the hidden advantage really worth. Simply because better volatility boosts the probability that the asset’s price tend to come to an even which makes the choice worthwhile. In this situation, financial prepayment choice rose during the worthy of on account of enhanced root appeal price volatility.

Graph step three plots of land the difference between the new second-mortgage-markets rate quicker the fresh 10-seasons Treasury rates facing a widely cited way of measuring interest volatility- the newest Disperse list. The new Circulate directory tracks the amount of Treasury rate volatility over a month which is intended of the possibilities on Treasury bonds. For example solution-implied rate volatility might be regarded as reflecting suspicion on tomorrow road of fundamental rates of interest.

Improved suspicion about the future roadway away from Treasury prices more than far of 2022 interpreted into enhanced thinking of your own financial prepayment option, boosting the latest bequeath ranging from financial-backed ties and a lot of time-dated Treasuries. Just like the elizabeth more confident towards upcoming roadway interesting cost within 12 months-end 2022, option-designed Treasury volatility decrease, and the give between financial-recognized ties and you can Treasuries then followed.

The latest part interesting rates uncertainty

Once the boost in mortgage cost through the 2022 try mainly motivated because of the upsurge in risk-100 % free Treasury costs, it actually was increased by expands regarding price of the loan prepayment solution, which reflected broader uncertainty towards upcoming highway of interest costs.